Travis County Emergency Services District No. 2 is committed to providing information concerning the use of taxpayer funding in an open and transparent manner.

The information below is provided in accordance with the local government transparency standards encouraged by the Texas Comptroller of Public Accounts.

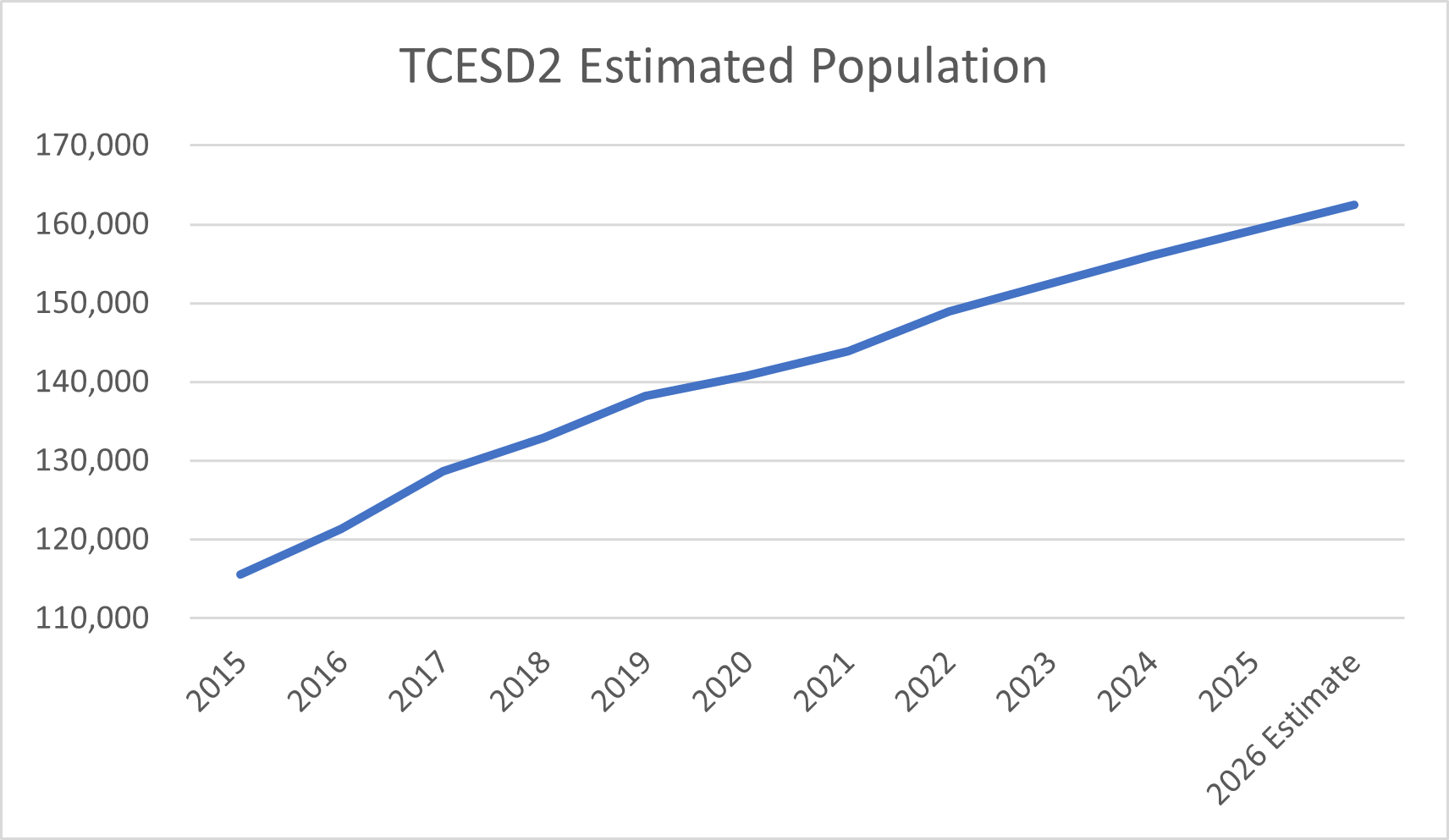

The population for ESD2 has grown significantly over the past few years. The population growth has led to an increase in call volume and longer response times due to additional congestion on roadways. Since the District’s service boundaries include only partial portions of delineated census tracts, population of the District is only an estimate.

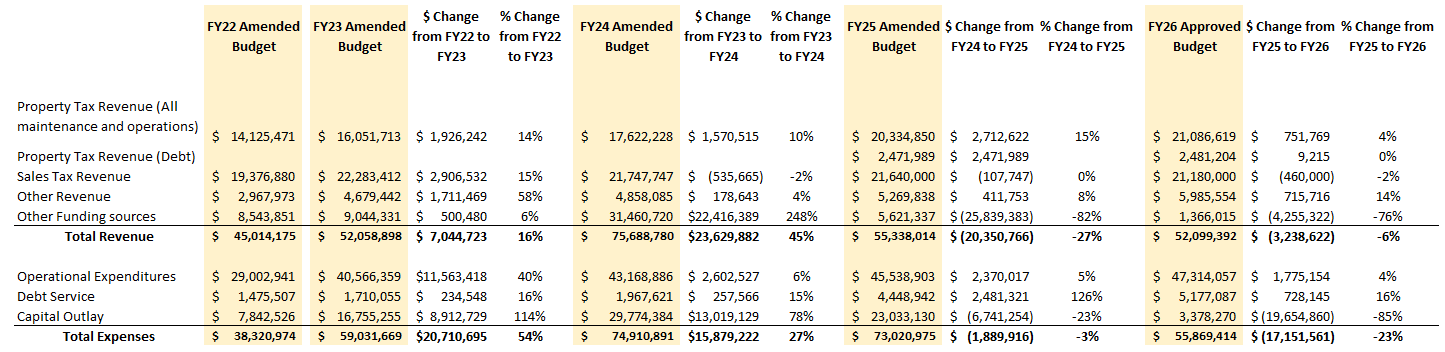

Travis County ESD No. 2 Budget Information

The Budget information below reflects the District’s current fiscal year budget as well as the four preceding fiscal years’ final amended budget amounts.

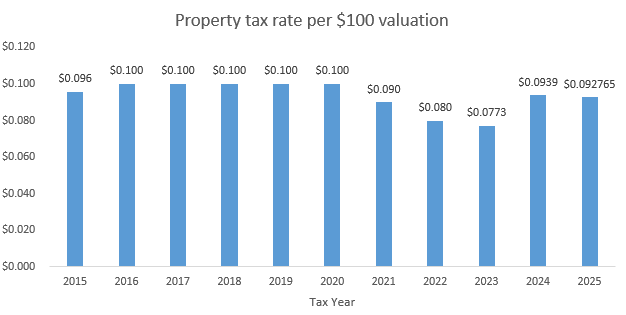

Travis County ESD No. 2 Maintenance and Operations and Debt Property Tax Rates:

Tax Year 2019: $0.1000 per $100 valuation;

Tax Year 2020: $0.1000 per $100 valuation;

Tax Year 2021: $0.0900 per $100 valuation;

Tax Year 2022: $0.0800 per $100 valuation;

Tax Year 2023: $0.0773 per $100 valuation;

Tax Year 2024: $0.0837 per $100 valuation;

Tax Year 2025: $0.082978 per $100 valuation;

Travis County ESD No. 2 Debt Property Tax Rates:

The District had a zero-debt service taxing rate and revenue for tax rates set for tax years 2019 through 2023.

Tax Year 2024: $0.0102 per $100 valuation.

The proposed tax rate for tax year 2026 (which will be used in the tax calculations for tax bills due 1/31/2027) has not yet been determined. This rate is typically set in September.

The total tax rate for 2025 decreased from the 2024 rate of $0.0939 to $0.92765 per $100 property valuation. The District’s 2025 tax rate was adopted by the Board of Commissioners below the voter-approval rate of $0.0942. Revenue from the 2025 tax rate is received in FY26 as taxes calculated with this rate are due in January 2026. The 2026 tax rate is planned to be set in September 2026.

Note: “Tax Year” represents the year of the property valuation that the tax rate is applied to. Tax revenue for each “Tax Year” is paid in the following fiscal year. Example: 2025 tax rates are applied to the Jan 1, 2025 property valuation and resulting tax bills are due Jan 1, 2026 to the taxing entity and therefore are recorded as fiscal year 2026 revenue. The District’s fiscal year 2026 begins October 1, 2025 and ends September 30, 2026.

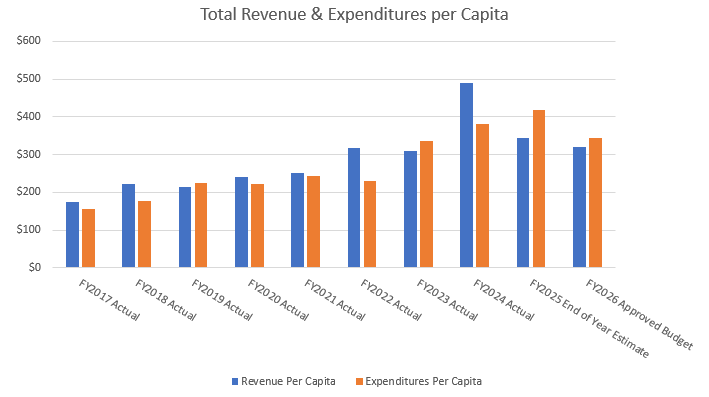

In FY20 expenditures were significantly reduced as the District discontinued non-essential services to respond to the COVID-19 pandemic and temporarily paused construction projects related to construction of new response locations and related equipment. These projects were restarted and saw significant progress in FY23 with continuation through FY25.

The TCESD2 total Revenue per Capita rose over the past few years because of an increase in the capital project funding (loans) obtained by the District to fund the construction of a new fire stations and training facilities fin FY24 and FY25. This large project was completed in FY25 which resulted in a decrease to the per capita revenue and expenditures as reflected in the FY26 budget data.

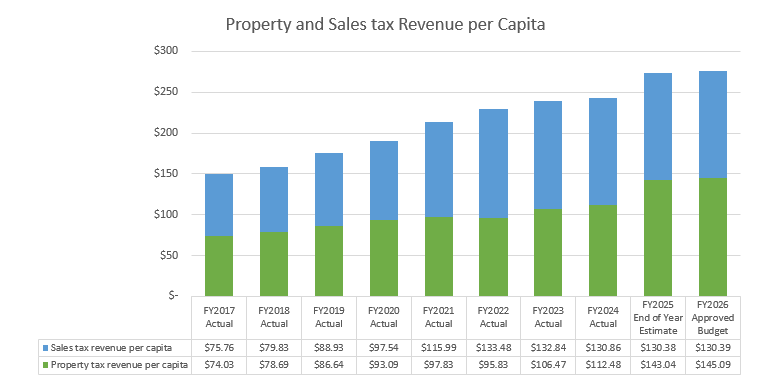

Generally, sales tax revenue had been increasing sharply as a result of area and economic growth, but started to slow in FY23 and continues to stagnate through FY25. The District’s expenditures per capita have risen over the past few years as the growth in the needs of the community have grown faster than the corresponding revenue. The District added new emergency response staff positions, purchased equipment, and built additional response stations needed to respond to increasing call volumes.

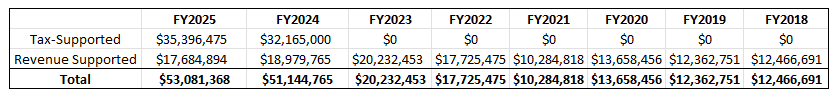

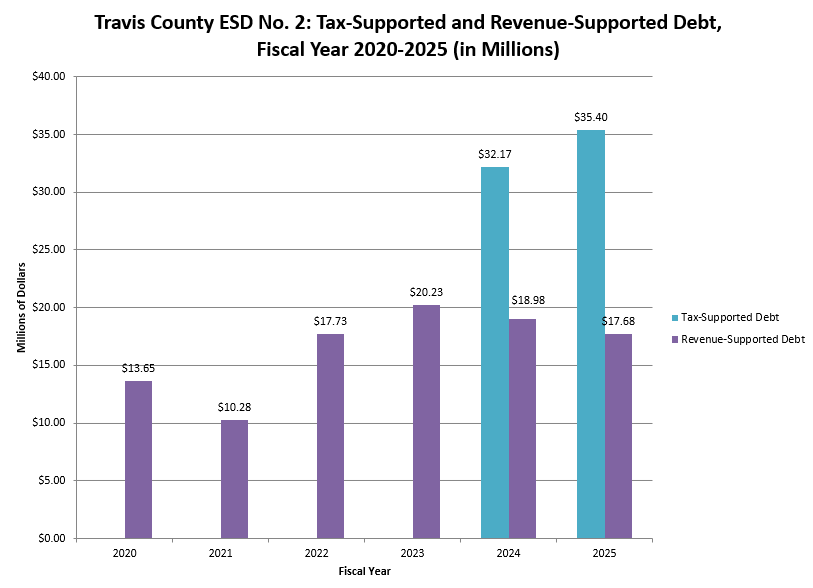

Travis County ESD No. 2 Debt Information

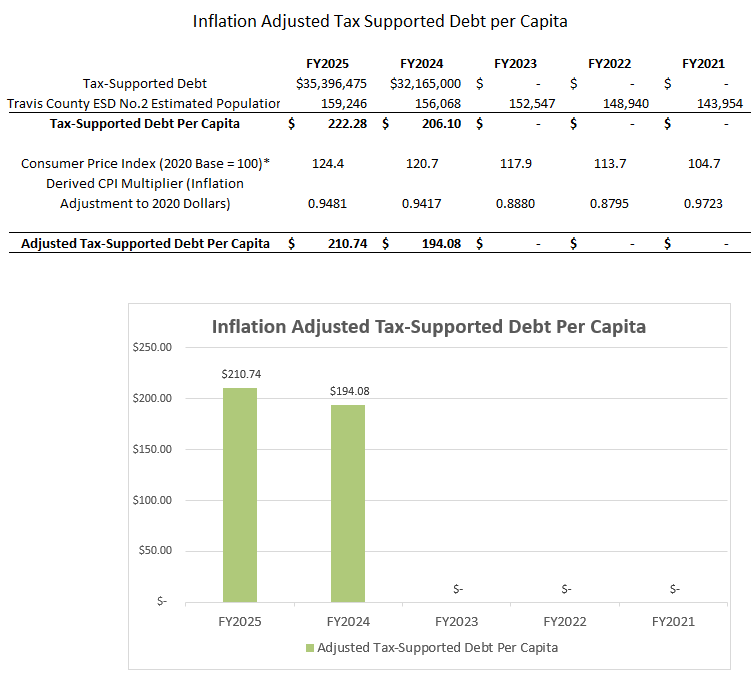

TCESD2 has included detailed debt information on this page for transparency purposes. TCESD2 hasn’t held a bond election since 2005. The needs of TCESD2 don’t generally rise to a level large enough to offset the expenses related to a bond issuance so TCESD2 typically acquires debt directly from financial institutions through a competitive request for proposal (RFP) process to ensure the lowest rate opportunity. In 2024, TCESD2 added two tax-supported debts and an additional was acquired in 2025. TCESD’s Board-approved financial policies guide the level of debt acquired by the District and are reviewed each time new debt is considered and annually during the fiscal year Budget development process.

Total Outstanding debt obligations: $53.08 million as of 9/30/25

Total Debt Obligations:

Total lease-purchase or lease-revenue obligations:

TCESD2 has no lease-related obligations.

Historical bond election information that includes date of election, purpose and amount:

There have been no recent bond elections for TCESD2. The last bond election was held in 2005, and all related obligations have been fully paid off.

Historical Trends

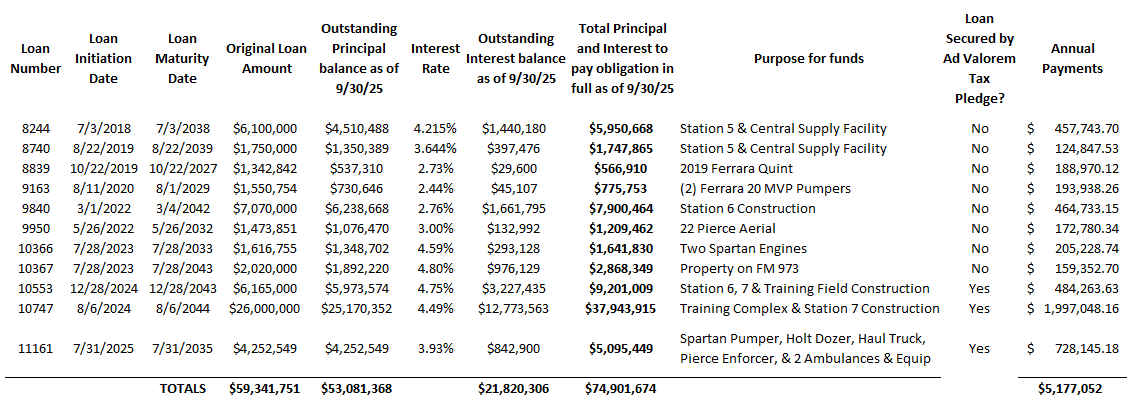

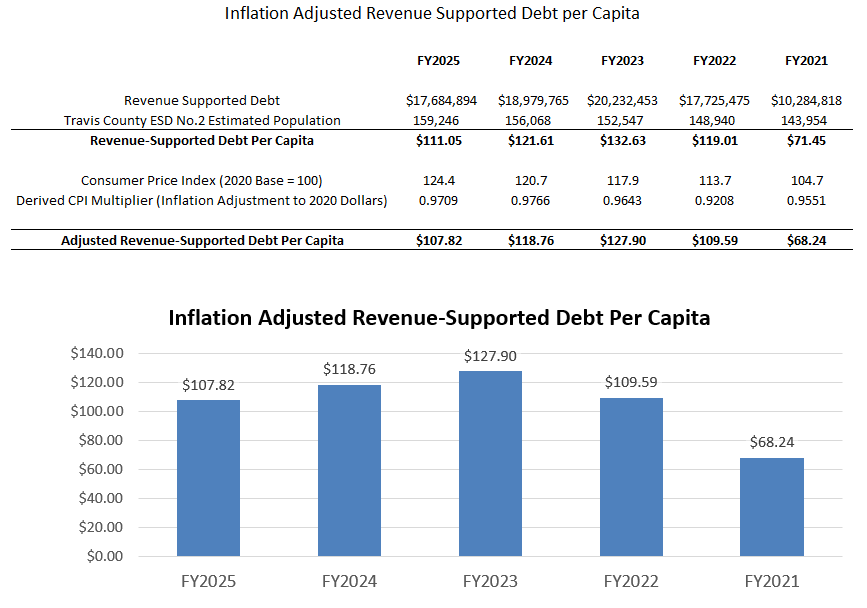

The District only had revenue-supported debt between fiscal year 2020 and 2023. Beginning In fiscal year 2024 the District’s loans were obtained with property-tax pledges on them.

Other information and Links

Travis County ESD No. 2 Financial Management Principles

Principles of Sound Financial Management establish a foundation for the fiscal strength and stability of Travis County ESD No. 2. These Principles guide the Board of Commissioners and Executive Team as they make fiscal decisions regarding resource allocations and annual appropriations. Fiscal principles assure sound stewardship of taxpayer dollars as they guide the District in the planning of expenditures, revenues and funding arrangements for public services and ensure budget flexibility and structural stability to weather economic cycles. The financial condition of the District must be maintained at the highest level to assure resources are available to meet the community’s ever-changing needs and these Principles reflect the District’s commitment to continued fiscal strength. To learn more about the District’s financial policies please click below.

Learn more about the District’s financial policies here.

Texas Government Code, Chapter 552, gives you the right to access government records; and an officer for public information and the officer’s agent may not ask why you want them. All government information is presumed to be available to the public. Certain exceptions may apply to the disclosure of the information. Governmental bodies shall promptly release requested information that is not confidential by law, either constitutional, statutory, or by judicial decision, or information for which an exception to disclosure has not been sought.